With this solution FacePhi provides a novel and very comfortable alternative for mobile banking users since they only have to take a selfie with their smartphone to access their bank accounts or operate in them.

Selphi® also guarantees high security in any operation, incorporating a liveness filter. With this technology it is able to distinguish between a photograph and the person in front of the mobile device.

This innovative technology improves the user experience effortlessly, simply by using the camera of the mobile device to take a selfie, thus becoming its method of identification and interaction with the bank’s mobile application.

Selphi

Selphi

$0.00-

Sale

Biometrics, Products

Biometrics, ProductsFacePhi Identity Platform: Digital Identity Verification in a tailor-made platform, which provides our clients with the tools and the advantage of being able to adapt the technology to each of their particular needs. A consumer driven platform that provides both customer and user with the most secure verification processes. All our biometric solutions in one so that you have it more accessible, so that you are more efficient.

$0.00$1.00

-

Biometrics, Products

Biometrics, ProductsPhiVox

Voice biometric solution to access or authenticate yourself in a call center.

$0.00

-

Biometrics, Products

Biometrics, ProductsLook&Phi

Solution that uses eye biometric to grant access or approve transactions with a look.

$0.00

-

Biometrics, Products

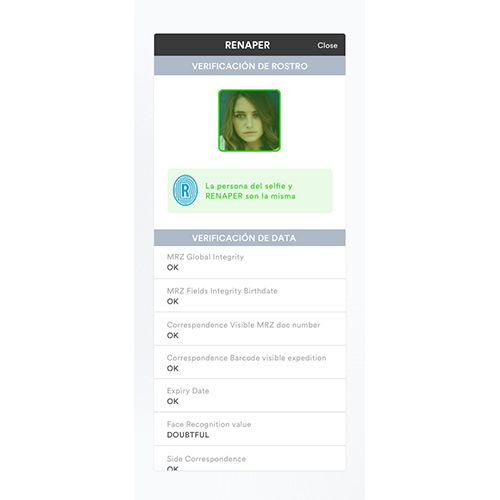

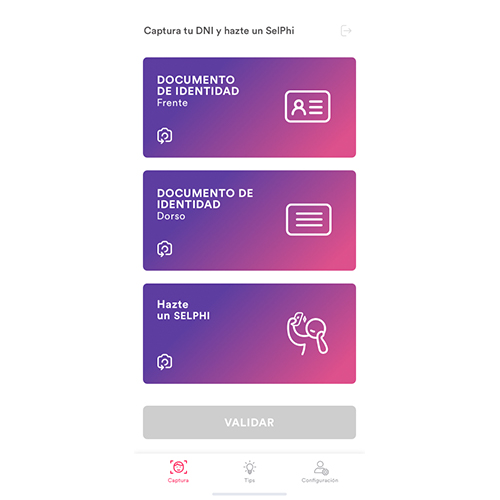

Biometrics, ProductsSelphID

Safe digital on boarding solution with the best OCR in the market, in real time and with passive facial liveness test, document validation and black lists.

$0.00

Facial recognition solution to access private banking or approve transactions with a selfie.

Selphi® is an easy to use technology thanks to its safe and fast user experience, that will allow the user to access their accounts in less than a second. With its encrypted pattern and the different liveliness systems it has, it has become one of the most reliable technologies on the market with a FAR & lt; 0.002%.

This innovative technology improves the user experience without effort, simply using the camera of your mobile device to take a selfie, thus becoming your method of identification and interaction with the bank’s mobile application. Taken the selfie, a pattern that is sent to the bank is extracted. This is recorded for later comparison in future operations.

With a strong concentration in the financial sector, our product is becoming a service used by banks around the world. Its implementation not only means savings for financial institutions, but also a way to attract customers and build loyalty while increasing transaction security, both for customers and the business.

Use cases:

– Mobile Banking Selphi®: Allows easy access by means of a selfie and supposes an increase in security, reducing phishing and identity theft. The technology is already integrated into the app that the user is using.

– ATM without card: The process begins by opening the app and logging in with a SelPhi® (facial recognition). You choose the option “Cash without card” and then the amount of money you want to extract. You will have to authenticate again to confirm the operation. Once this is done, they will receive an OTP (single-use and for a short period). Finally, the OTP is entered into the ATM and cash is withdrawn.

– Web banking with QR: First, you must open the bank’s app and scan the QR code from the bank’s website with the app. You have to verify the session with SelPhi® (facial recognition) and then you can have secure access to your bank accounts and operate from the PC.

Selphi is already being used by banks such as HSBC or ICBC in Argentina, Banco Industrial in Guatemala and Banco Inbursa in Mexico, among others.