What’s FINARGY?

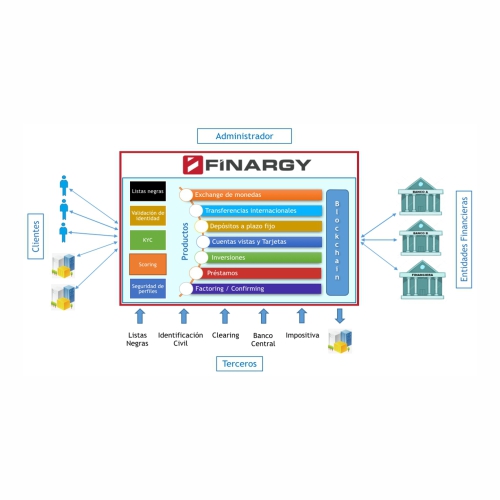

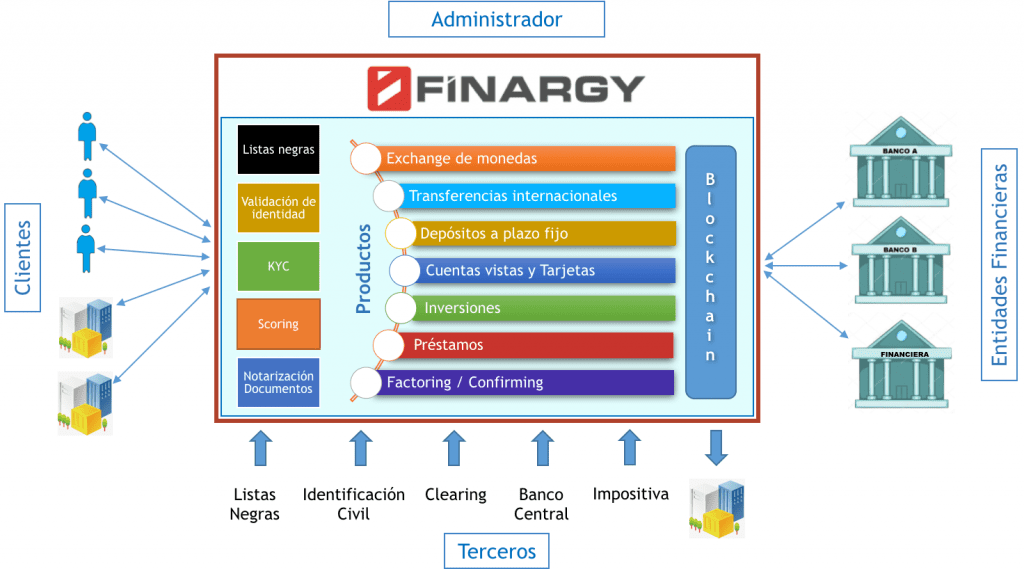

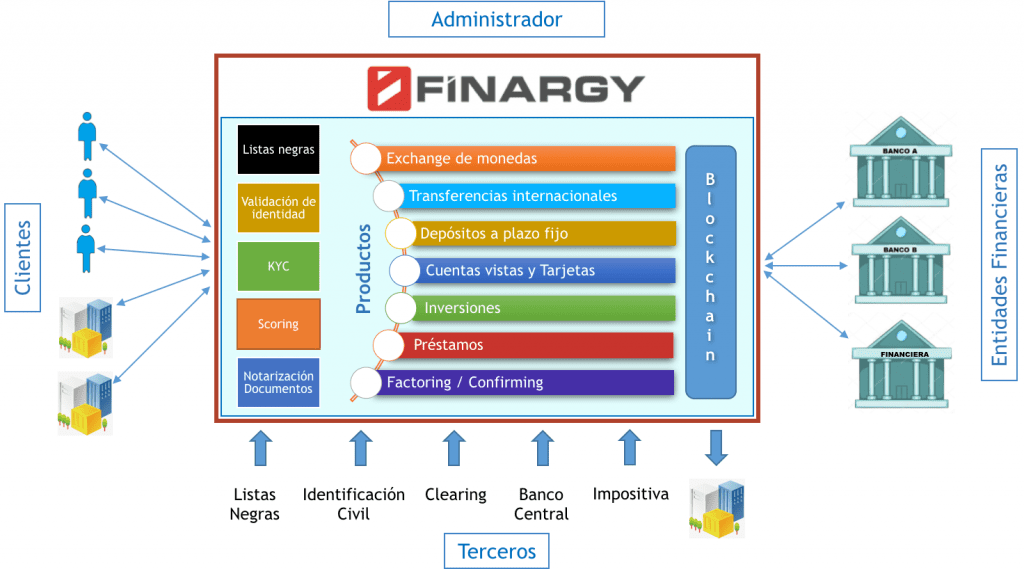

FINARGY is a cloud platform based on Blockchain technology and Open APIs that allows collaboration between Financial Entities so that they can be more efficient and, in turn, provide innovative services through a new, attractive and low-cost distribution channel.

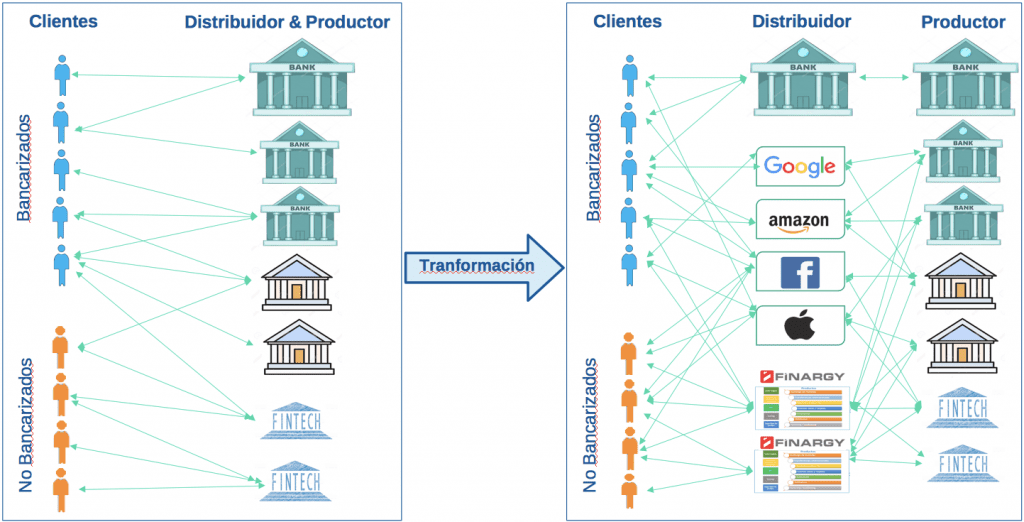

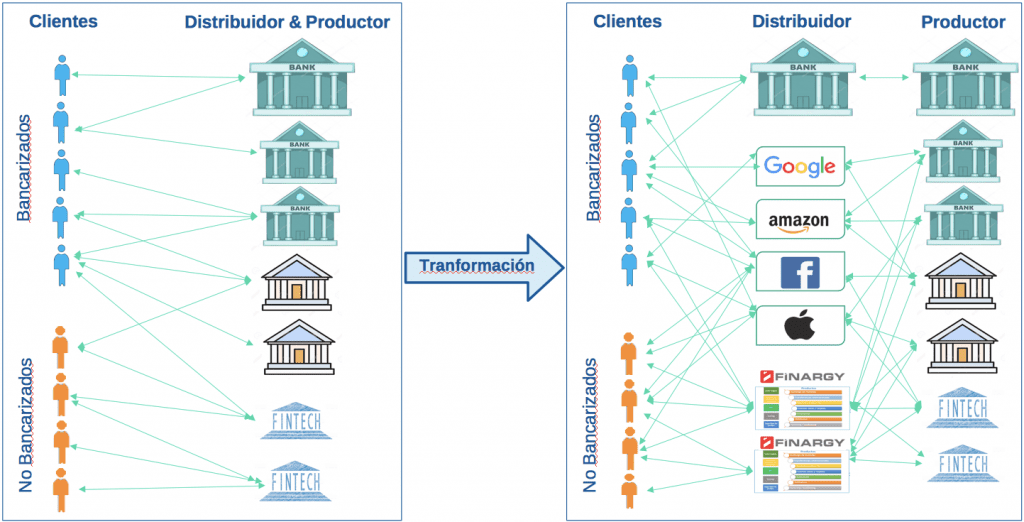

FINARGY is positioned as a platform for distribution of financial services designed for the Open Banking era.

What characteristics does it have?

FINARGY is based on Blockchain technology, which for the first time, allows to generate value through synergy and collaboration between Financial Entities in an agile, secure, transparent way, with privacy and confidentiality. In addition, it includes APIs to connect to the financial systems of the institutions.

These characteristics allow to optimize processes common to multiple Financial Entities without.

compromising the privacy and confidentiality of the information. The processes are carried out only once for all institutions, reducing costs and times, and improving the customer experience.

On the other hand, they allow maintaining a single channel for the distribution of financial products, which allows more clients to be reached at a lower cost, make better risk decisions and capture customers, and obtain a larger scale quickly.

FINARGY is a platform based on services, modular, parameterizable, scalable, integrable, with data analytics and protection of privacy and information security for all members of the ecosystem.

What are the key benefits for banks and other financial institutions ?

- Cost reduction based on:

- Fewer clients in physical branches.

- Lower cost of KYC because of being shared.

- Lower risk thanks to shared Scoring.

- Lower cost for customer acquisition.

- Less onboarding time.

- Higher income due to:

- Attracting new customers by new sales channel:

- Large EFs access new markets

- Small EF achieve greater scale

- Best customer experience

- Higher profitability based on better customer knowledge using Data Analytics.

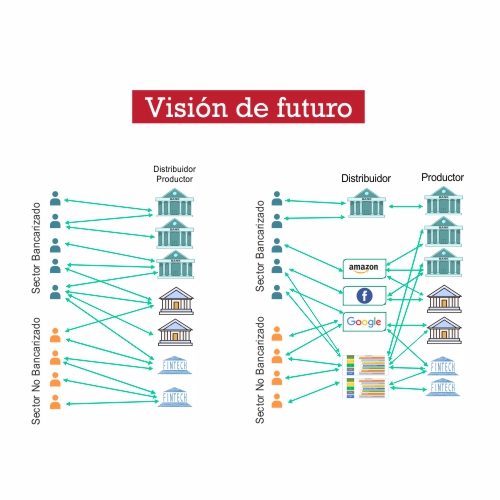

- Incorporate typical Fintech’s flexibility and innovation into the stability and trust generated by traditional Financial Institutions.

FINARGY is based on Blockchain technology and Open APIs which allows collaboration between Financial Entities so that they can be more efficient in processes such as KYC, Scoring and Document Notarization. The product allows to optimize common processes without compromising the privacy and confidentiality of the information. The processes are carried out only once for all institutions, reducing costs and times, and improving the customer experience.

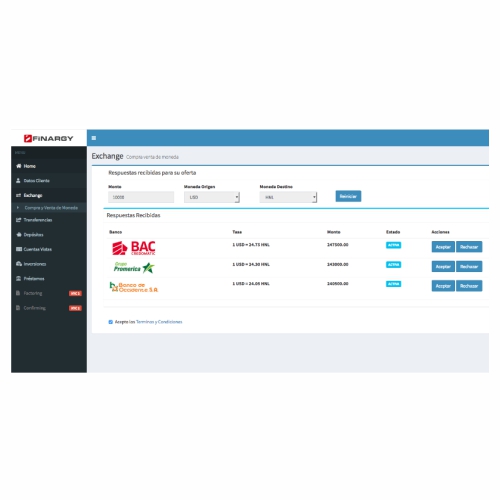

On the other hand, FINARGY allows to maintain a single channel of distribution of financial products, which allows to reach more clients at a lower cost, make better risk decisions and capture clients, and obtain a larger scale quickly. The product constitutes a new, attractive and low-cost distribution channel, where banked and unbanked customers can access multiple products from an ecosystem of Financial Entities, compare and select the one that best suits their needs.

What are the use cases?

FINARGY allows a consortium or group of Financial Entities to reduce operating costs through collaboration for KYC, Scoring, Document Notarization processes:

- For KYC, the validation process is performed only once for all the associated institutions, avoiding performing the same task by multiple institutions.

- For Scoring, the information in the Blockchain is consolidated, which can be consulted by all the institutions that have adequate access.

- In relation to Notarization of documents, this process allows to certify and validate documents that must be shared between several institutions and third parties. The owner of the document is the one who gives access and permissions to whom he deems appropriate.

On the other hand, FINARGY allows attracting new customers to the ecosystem through a Marketplace of financial products, increasing market coverage and maximizing customer experience.

- It allows customers to access multiple products from multiple institutions in one place, compare them and select the one that is convenient for them.

- It allows attracting unbanked or non-ecosystem customers and incorporating them economically.

Bantotal agreement is a key alliance for the development and expansion of our product. Bantotal is a leading banking core provider in the region, with an open philosophy and aligned with our business model and philosophy. FINARGY is the perfect partner for Bantotal to unlock the synergy of financial ecosystems in the new era of Open Banking.

FINARGY was created by members of the Blockbear Blockchain for Business company. It is made up of technology, blockchain and business experts, with extensive experience in the IT market. The entrepreneurship arose from a research paper on the use cases and the potential of Blockchain technology in the financial industry. The research focused on the analysis of use cases globally, and with regional and local application. It was conducted by business and technology experts of BlockBear and advised with experts from the Banking industry.

More information