Asistente Virtual

Asistente Virtual

$0.00Virtual Assistant

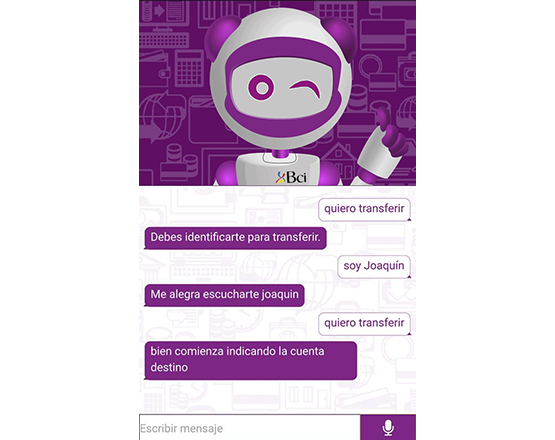

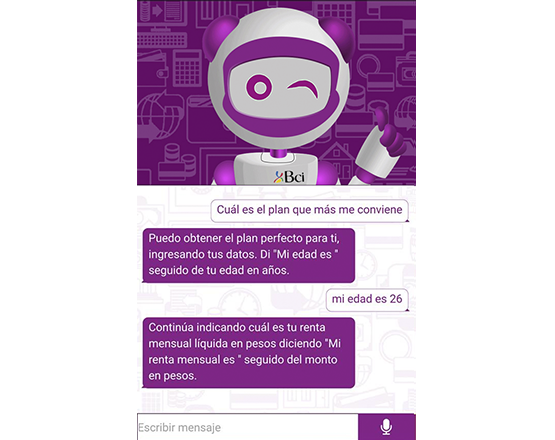

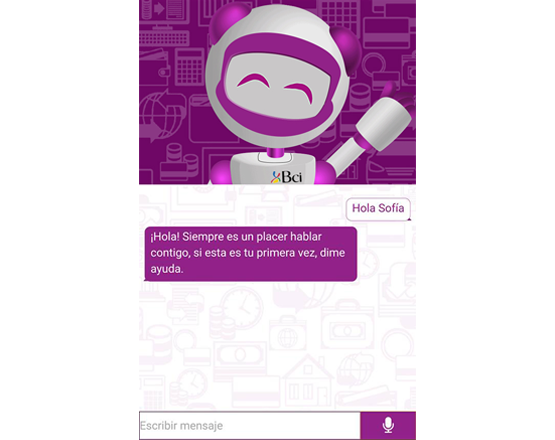

A new way to communicate

From the “Call Center” to the personal assistant, SofIA can respond to customer inquiries quickly, simply and efficiently. At any moment, in any place!

SofIA is a novel way of communicating through your chat or voice with your institution, not only answers questions, it is also able to communicate through WebServices with your API and perform actions such as balance inquiries, transfers or online purchases.

Connection with Webservices

Connect our services to your API and provide infinite solutions to the customer at all times.

Customer Service

A new way to communicate with your customers, your company always available to satisfy their needs.

More information: www.sofiacorp.com

Related products

-

Communication, Compliance, Credit, Document Digitalization, Management, Products

Communication, Compliance, Credit, Document Digitalization, Management, ProductsOnBase

OnBase is an ECM / document management solution that streamlines processes at the department level, yet has the ability to easily scale across the bank. It has the ability to integrate with important systems for the bank, as well as with any new technology.

It meets ECM requirements, in addition to having functionality that far exceeds the standard of other ECMs. OnBase also provides case management, business process management (BPM) and capture technologies on the same platform, which can be extended with File Synchronization and Sharing Solution ShareBase. The OnBase platform can be integrated with an existing environment, deployed for use on mobile devices, and available either on-premises or in the cloud.

Por Nexo IT

-

Communication, Payments, Products

Communication, Payments, ProductsIndependent solutions that help you drive better results for your customers and your business throughout the entire customer journey.

Por Infobip

-

Analytics, Artificial Intelligence, Compliance, Products, Security

Analytics, Artificial Intelligence, Compliance, Products, SecurityPSFraud

PSFraud is a web application / backend system that uses which can respond in real time to the threat of fraud. PSFraud uses sophisticated mathematical and classification (Artificial Intelligence, Machine Learning) technology that provides self-learning capabilities. Additionally, PSFraud incorporates different best known computing techniques, combining them in the most efficient way in order to produce better external fraud detection rates on multiple channels with lower alert levels.

The learning capacity allows to continuously update the profile of each consumer or of an analysis object whose pattern you are looking for. It does this to assimilate the knowledge of the consumer or object and to automatically update the rules and parameters necessary to stop the problem. Predisoft’s analysts, however, are regularly reviewing the analysis results with your specialized staff with the aim of making sure the efficiency level is always optimal.

Predisoft has also specialized PSFraud for internal fraud detection purposes with PSFraud-Internal, and has also offers an authorizer level solution with PSFraudAuthorizer.

Por Predisoft$0.00

-

Analytics, Artificial Intelligence, Compliance, Products, Security

Analytics, Artificial Intelligence, Compliance, Products, SecurityPSFraudAuthorizer

PSAML is a web application that runs on servers communicating with Bantotal’s Banking Core. PSAML is a robust solution which monitors your institution’s electronic transactions looking for suspicious behavior, thereby complying with your anti-legitimization / anti-money laundering program, under the concept of an all-in-one system.

The PSAML computer application has had years of development and increasingly offers more and more features that make it innovative, complete and effective.

Both with a simple and friendly design, with a effective architecture, as well as with computational-mathematical technology specialized in profiling and atypicality detection, and together with best practices and expert knowledge, the tool is capable of alerting transactions and suspicious behavior. Suspicious cases can be investigated in detail employing any number of personnel throughout the organization, employing a general workflow sub-system.

Additionally, Predisoft has a mathematical laboratory for data analysis, where we perform segmentation and profiling processes in addition to collaborating with the creation of risk rating matrices for both customers and products.

Por Predisoft$0.00

-

Communication, Products

Communication, ProductsalveoCCM

alveoCCM is a software platform intended to manage and optimize the customer

communication process in financial institutions.The platform processes the whole set of bank’s communications with its clients. For this

purpose, all communication channels available in the company are used, always in accordance

with the legal issues and communication preferences of the clients.The infrastructure is fully integrated with Bantotal core banking. Communications linked to

bank core operations (settlement notices, bank statements, transaction receipts, operations

alerts, etc.) are managed and distributed through the CCM Alveo system, without developing

cost-consuming customized interfaces.alveoCCM brings added value to Bantotal users, such as global tracking of communications,

cost savings and easy implementation of new digital channels.

In addition, Bantotal core banking users can use a comprehensive set of services provided by

alveoCCM, including communication capture, monitoring and recovery from other alternate

channels or corporate systems.$0.00

-

Communication, Management, Products

Communication, Management, ProductseXpand

eXpand is a family of services and solutions created to manage Contact Centers without depending on the provider deadlines. Our omnichannel software improves the customer service experience and increases the productivity of your Contact Center through digital channels, voice and Bots in a single web platform manageable by non-technical users.

Key features include, among others:

- WhatsApp Support

- Social Selling

- Call Center and Telephone Exchange

- WhatsApp, calls and SMS campaigns

- IVR Web Designer

- Home Office solutions

Por eXpand$0.00

-

Artificial Intelligence, Automation, Products

Artificial Intelligence, Automation, ProductsSoftBotic

SoftBotic offers business process automation products and services through RPA Robots under UiPath and Artificial Intelligence platform, trained to execute tasks in computer systems with great precision and speed, efficiency and productivity, generating great savings for financial institutions, thus restructuring the workforce towards a comprehensive strategy of digital transformation.

Por SoftBotic$0.00

-

Analytics, Artificial Intelligence, Compliance, Products

Analytics, Artificial Intelligence, Compliance, ProductsPSAML

PSMLA is a web application and backend software system that analyzes electronic transactions of various kinds. It is used to monitor transactions and detect suspicious patterns related to various forms of Money Laundering.

The PSAML system is all-inclusive: it allows for monitoring, reporting, blacklisting, execution of workflows, population segmentation and for the creation of risk rating matrices, all unified in the same system, thereby optimizing all the management of compliance departments in financial entities.

Por Predisoft$0.00