SoftBotic offers business process automation products and services through RPA Robots under UiPath and Artificial Intelligence platform, trained to execute tasks in computer systems with great precision and speed, efficiency and productivity, generating great savings for financial institutions, thus restructuring the workforce towards a comprehensive strategy of digital transformation.

SoftBotic

SoftBotic

$0.00

SoftBotic offers business process automation products and services through RPA Robots under UiPath and Artificial Intelligence platform, trained to execute tasks in computer systems with great precision and speed, efficiency and productivity, generating great savings for financial institutions, thus restructuring the workforce towards a comprehensive strategy of digital transformation.

Robots are here to stay. The faster you harvest their potential, the faster you create a competitive edge for your business. Robotic Process Automation delivers direct profitability while improving accuracy across organizations and industries. Enabling RPA to handle any processes will not only transform and streamline your organization’s workflow. It will allow for superior scalability and flexibility within the enterprise, doubled by fast, tailored response to specific needs.

What features does it have?

RPA robots are capable of mimicking many–if not most–human user actions. They log into applications, move files and folders, copy and paste data, fill in forms, extract structured and semi-structured data from documents, scrape browsers, and more.

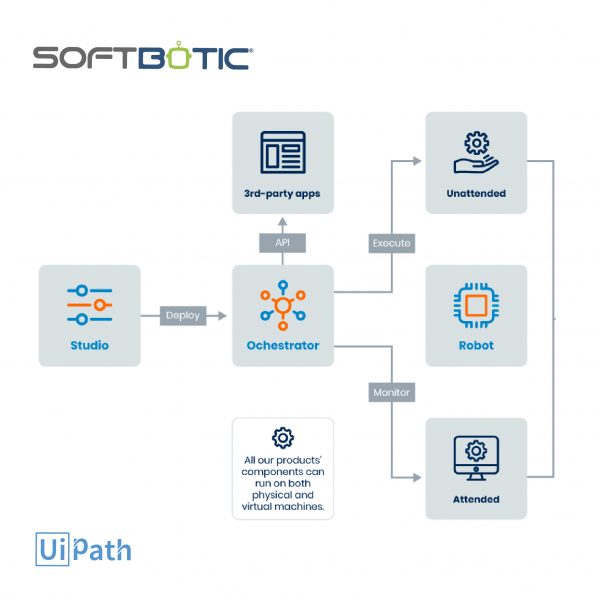

UiPath Robots

UiPath Robots are a fundamental component of the UiPath Enterprise RPA Platform. Robots execute the automation workflow designed and can be centrally managed from UiPath Orchestrator. To cater to diverse automation scenarios, UiPath offers both Attended and Unattended Robots.

UiPath Orchestrator

Imagine thousands of Robots at work. They’re running tens of thousands of automated processes.

With UiPath Orchestrator in command, your entire virtual workforce is controlled, managed and monitored securely in one place.

Imagine thousands of Robots at work. They’re running tens of thousands of automated processes.

With UiPath Orchestrator in command, your entire virtual workforce is controlled, managed and monitored securely in one place.

Services we offer with SoftBotic RPA / UiPath technology:

Proof of Concept RPAUiPath (PoC)

A proof of concept (Po) has the objective to demonstrate the capacities and __that RPA/UiPath has over any particular challenge proposed by a firm.

Process Analysis As-IS and Process Design TO-BE

We support firms with a diagnosis and current process selection (manual ones), and then propose a redesign of the process but automated with RPAUiPath.

Process Automation by RPAUiPath technology

After the RPA solution design, the bot is trained, so it executes the process automation in an attended or unattended way (orchestrator)

Maintenance and Support to Automation -RPAUiPath

After the period of post-production support and warranty, the client can acquire a maintenance and support plan. This one provides excellent benefits in the mid and long-term.

Support to the Creation of a Centre of Excellence (CoE)RPAUiPath

A CoE is basically the manner to integrate RPA in a serious and effective way inside a corporation, and share the knowledge gained, together SoftBotic a roadmap is created to enhance the value in a financial institution

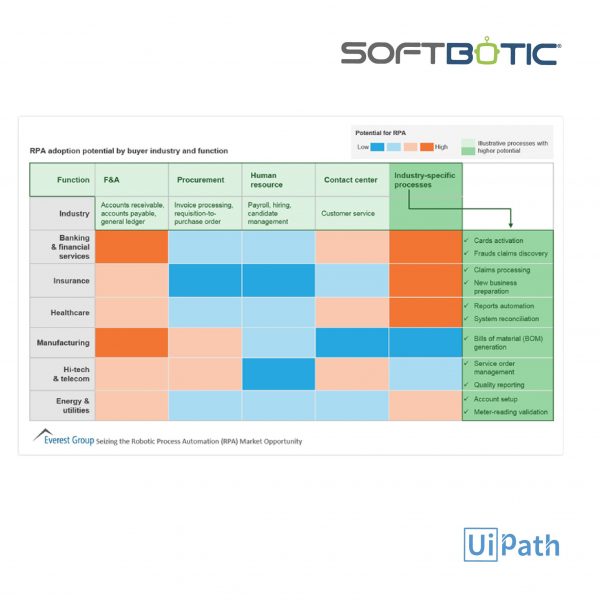

What are the benefits it provides to banks?

![]()

Better accuracy

Robotic Process Automation software robots are programmed to follow rules. They never get tired and never make mistakes. They are compliant and consistent

![]()

Improved compliance

Once instructed, RPA robots execute reliably, reducing risk. Everything they do is monitored. You have the full control to operate in accordance with existing regulations and standards.

![]()

Fast cost savings

RPA can reduce processing costs by up to 80%. In less than 12 months, most enterprises already have a positive return on investment, and potential further accumulative cost reductions can reach 20% in time.

![]()

Super scalable

Across business units and geographies, RPA performs a massive amount of operations in parallel, from desktop to cloud environments. Additional robots can be deployed quickly with minimal costs, according to work flux and seasonality.

![]()

Increased speed and productivity

Employees are the first to appreciate the benefits of RPA as it removes non-value-add activities and relieves them from the rising pressure of work.

What are some use cases?

![]()

Customer Service

Banks handle multiple inquiries every day, from account information to applications statuses and balance. Banks find it difficult to respond to inquiries with a reasonable response time. RPAUiPath can be integrated into emails, callbots, chatbots and other channels to support backoffice and aid in the integration with multiple systems that must be accessed in order to obtain the information and thus be able to provide a fully automated customer service.

![]()

Fraud Detection (Audit Robots)

With the introduction of digital systems, one of the main concerns of banks is fraud. It is really difficult for banks to track all transactions to mark the possible fraudulent transaction. However, RPAUiPath can track transactions and raise a red flag of possible patterns of fraudulent transactions in real time or in daily processes. In some cases, RPAUiPath can prevent fraud by blocking accounts and stopping transactions.

![]()

Credit Card Processing

With the help of RPAUiPath, banks can now process credit card applications in a matter of hours. RPAUiPath can speak with multiple systems to validate information such as required documents, background check, credit review and make the decision based on rules to approve or disapprove an application.

![]()

Credit Factory Automation

The approval process for a loan goes through several verifications such as: credit review, payment history, document verification, risk analysis, among others. A small error can slow down the process. As the process is based on a specific set of rules and validations, RPAUiPath can accelerate the process and eliminate the bottleneck by enabling the automation of the credit factory of your institution, allowing high scalability and enhance the opening to disruptive channels such as Fintech.

![]()

Insurance Banking Operations

In the broadest sense, insurance banking consists of the distribution of insurance products through the client portfolio of banking entities, in other words, a distribution channel. But this operation tends to be complex and expensive, whether there is an exclusive bank-insurance company relationship, or even if the bank works with different companies, which is more complex.

With RPAUiPath, the integration of banking and insurance becomes possible, allowing automation from the quoting process of insurance products through insurance portals, until its issuance, which often involves uploading documents, uploading KYC information to the portal of the insurer (for regulatory matters), and then the update of this information in the Banking Core. RPAUiPath also supports the whole life cycle of the administration of the policy remittances of payment, renewals, cancellations.

![]()

KYC process

Know your customer (KYC) is a mandatory process for banks for all its customers. Considering the cost of a manual process, banks have started using RPAUiPath to validate customer data. With the new cognitive capabilities of UiPath Document Recognition, it is possible to process unstructured documents, document classification, allowing greater precision; banks no longer have to worry about the process as it can be completed with a minimum of errors and personnel.

![]()

Other cases that we can mention:

Robots to support Comex operations.

Robots to support Private Banking operations.

Robots to support Administration:

– Bank and Credit Card Reconciliations.

– Payroll Operations and Human Resources

– Purchase Orders and Invoices Processing

Robots to support the Bank IT:

– User authorizations

– HelpDesk Automation

– Closing Processes Execution

– Support in data migrations for portfolio purchases

– Support in Massive Generation of Test Data.

What are some of the success stories

Banco Delta: Automatización de Fábrica de Créditos.

Atlantic Security Bank: Robot Auditor.